I was talking with a friend of mine about financial planning recently, and she somewhat sheepishly admitted that she and her spouse spend considerably more time planning for their vacations than they do for their retirement. Afterward I realized that planning for both has many similarities. Everyone has a different ideal vacation destination. Some like the beach, some like the …

Costs Matter More Than You Think

There are three simple time-tested rules in investing. But, like a lot of things, they are in need of an update. This is the second post in a three-part series. The first post in this series discussed the importance of diversification. Our Updated Rule #1 was: Diversify to the point of discomfort to control risk. Now for Original Rule #2: …

When Finding Your New Normal, Don’t Forget the Most Important Part

Are you contemplating a career change or perhaps weighing the pros and cons of retirement? Maybe you’re anticipating the arrival of a new baby or you have children who are ready to leave the nest. Or, on a more somber note, is the realization of divorce on the horizon or are you trying to find your way after experiencing the …

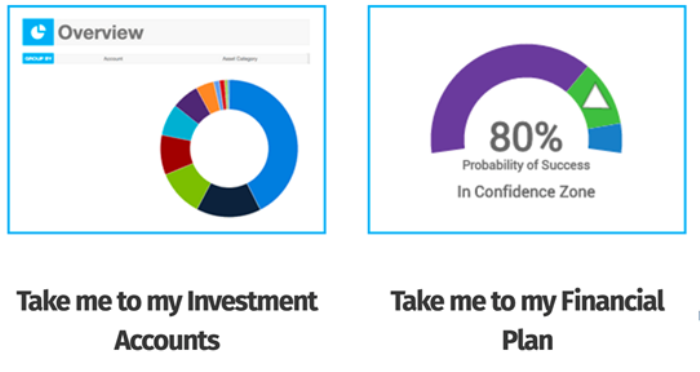

Brilliant Advice’s Client Portal – 12 Features You Will Love

Five years ago you learned online banking. Perhaps you didn’t realize what it could do for you, but then you tried it out. Now, would you want to live without it? That’s banking. How about investing? Can you access ALL of your investment accounts online in one location today? There is no reason why not. That technology is available to …

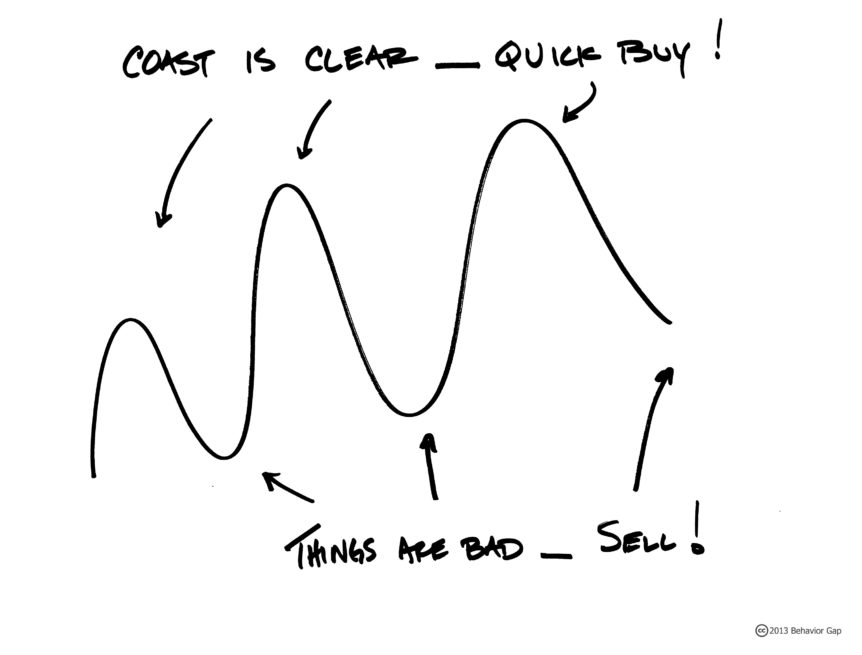

Does your Advisor Invest Emotionally?

Many investors, letting their emotions get the best of them, fall into the trap of chasing investment returns. After a sustained period of strong results, they buy, and after a painful downturn, they sell. Of course, no investor likes to admit to acting this way. But do financial advisors suffer from the same issue? Is your financial advisor an emotional …